|

Dr. Ken Rietz |

|

|

|

For this spreads commentary, I want to return to simple vertical option spreads and emphasize how similar bull call and bull put spreads are, and talk about intrinsic and extrinsic values of options and about options that are exercised. I used vertical spreads in a commentary on RBOB. Please refer back to that article for background. Please note some of this applies to options, and not futures. A vertical option spread happens when:

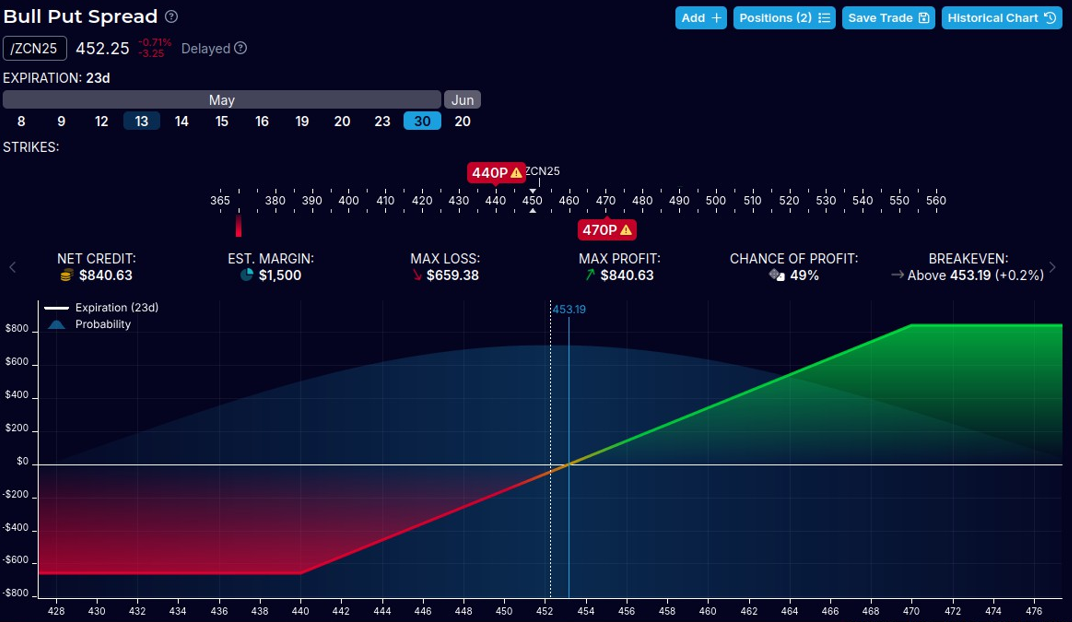

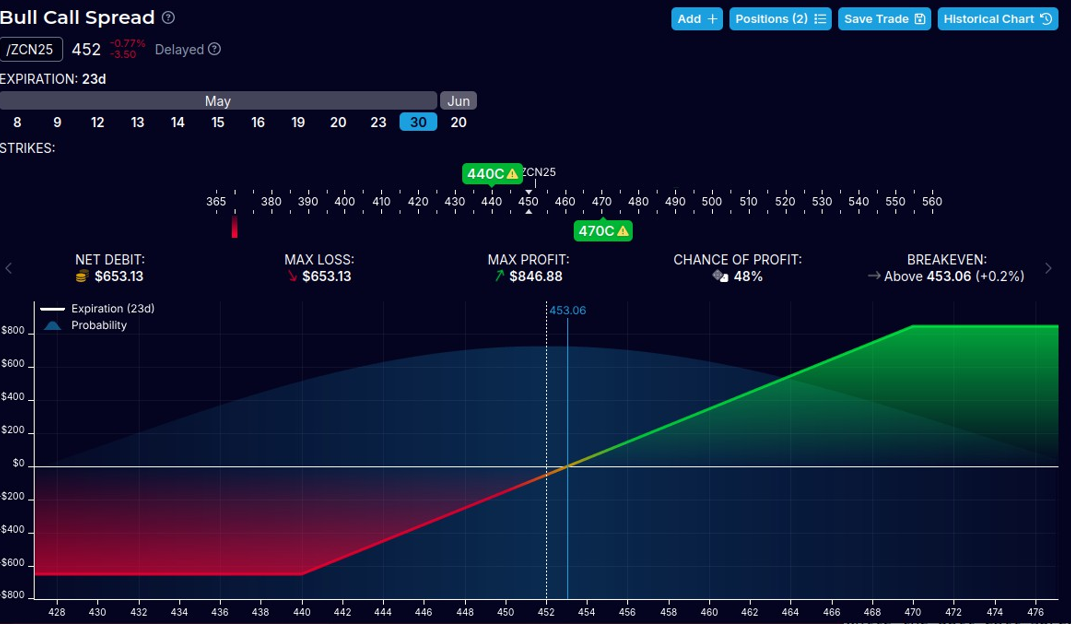

Essentially, the same criteria apply for vertical futures spreads. The intention of establishing the trade is to have the underlying move from one strike price to the other, and to generate profits from that transition, either for hedging or investment purposes. It is counterintuitive that, once established, bull put spreads and bull call spreads have the same characteristics. The following two charts show both bull spreads (put and call) from 440 to 470 on ZCN25 (July Corn futures). The differences between them, as you can read in the values above the graphs, are much less than 1%. |

|

|

|

This means that you could use bull put and bull call spreads equivalently, except that there are some very important differences. The most obvious is that the bull put spread is a debit spread (you pay to establish the spread), while the bull call spread is a credit spread (you are paid to establish the spread). For a debit spread, you expect that the spread will be worth more when the spread is closed for a net profit, while for a credit spread, you expect not to lose the money you gained at the start and profit that way. Because you can lose more than you are paid in a credit spread, you also will be assessed a margin to cover some of what you might lose. The source of the difference between the two spreads is the order of the buys and sales. Note that you can also create bear call spreads and bear put spreads. Parallel statements can be made for them. This brings up a whole new idea in options: being exercised early. Options and futures contracts can be bought and sold at any time before their expiration. Futures contracts are exercised (meaning their obligations are implemented) on expiration day. Option contracts can be exercised at any time on or before the expiration day. The conditions favorable for an option being exercised leads us to another topic. Every option has a value, split into two parts: intrinsic and extrinsic. The intrinsic value is determined by its strike price and the value of the underlying. The extrinsic value is a lot blurrier, determined by the time left to expiration, and is the part of the option price that decays to zero at the expiration date. The premium (or value) is the sum of these two pieces. An option that was sold could be bought by anyone, but it generally won’t be bought if the extrinsic value is large, since only intrinsic value will be available to the purchaser. That means that sold options won’t be bought until near the expiration date, although there is also extra risk near ex-dividend dates. This has the effect that you will rarely see bull call spreads, since it exposes a sold call with a higher strike price, leaving it more vulnerable to being exercised. Similarly, a bear put spread exposes a sold put with a lower strike price and is more likely to be exercised. The result is that you will only see bull put spreads and bear call spreads, and those are the only ones that you should use. Here is an example comparing bull call spreads and bull put spreads on July corn (ACN25). Again, a similar example could be created for bear put spreads and bear call spreads. The volume on this is very low, so spreads are high, making this for illustrative purposes only. You can establish a bull put credit spread by selling a 440 put and buying a 475 put which gives you a credit of $1.078.13, a potential max loss of $671.88, an estimated margin of $1,750, and a potential max profit of $1,078.13. A bull call debit spread obtained by buying a 440 call and selling a 475 call, for a cost of $668.75, a potential max loss of $668.75, and a potential max profit of $1,081.14, with no margin. (Some of the differences in figures is due to moment-to-moment changes in options prices.) It is clear that there is little difference between them, except for the possibility of exercising the sold strike of the bull call spread, as it approaches expiration. |