|

Dr. Ken Rietz |

|

|

|

S&P Global has published an article that takes a careful look at the future of EU natural gas under two scenarios regarding Russian natural gas operations. One scenario has Russia restoring natural gas supplies to the EU, called “Opening the Taps” and the effects it has on US LNG exports. The other scenario has ever-tightening sanctions on Russian natural gas, called “Phasing Down” and again the effect on US LNG exports. In this commentary, we want to look at what nations are doing, not just speaking, about the likelihood of those two scenarios. We don’t try to come to a conclusion, since too much can change too rapidly, but knowing how EU countries are preparing gives a sense of the way they expect things to work out. But first, we want a graph of the net amount of LNG exported from the US. Note that at least 50% of US LNG goes to the EU, historically (53% in 2024; 72% in 2023). |

|

|

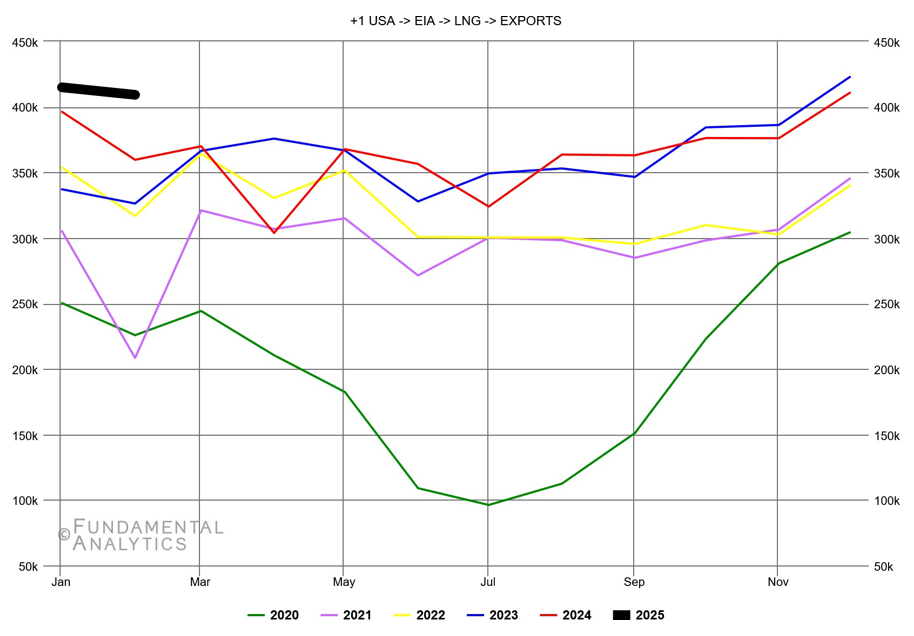

Figure 1: Net amount of LNG exported from the US in thousands of metric tons Let’s set the background for the discussion. The EU received more than 40% of its natural gas from Russia before the sanctions. This dropped to about 11% in 2024. (Hungary and Slovakia still get Russian gas.) It is understandable that this was a challenge for the EU, and it hasn’t gotten any easier to eliminate completely Russian gas, over Hungary’s and Slovakia’s objections. One way to evaluate the two scenarios would be to look at statements from different EU members. My preference is to look at what the EU members are actually doing; actions speak louder than words and tend to be more valuable in the long term. Next, we take the various actions by country or the whole EU that support the “Phasing Down” scenario. The most notable one is that the entire EU has a detailed plan (EU/2022/1032) to eliminate all Russian energy, natural gas, oil, and nuclear energy, by 2027, as a part of moving to green energy (as part of the REPowerEU plan launched in 2022). In 2024, however, the EU still imported 52 billion cubic meters of Russian gas, prompting new measures that require each member state to submit national phase-out plans by the end of 2025. This must be considered as a serious move, since it is not simply a reaction to Russia’s invasion of Ukraine. Another data point for this scenario is Germany’s construction of an LNG-receiving port. The port was planned immediately after the Nord Stream pipeline was sabotaged, so it might be considered as an attempt to increase natural gas from Russia from Yamal LNG plant. But the fact that the agreements being signed are with the US and EU (Norway) says otherwise. One more point for this scenario is Spain. It already imports 35% of its natural gas from the US. Spain clearly is not expecting to import more gas from Russia. Now, let’s look at factors that might lean toward the “Opening the Taps” scenario. There are, as mentioned before, Hungary and Slovakia. They are very much Russia-aligned and have been customers of Russian gas for years. They, obviously, don’t want to buy more expensive gas from elsewhere. However, they are a small minority in the EU. There is one more factor that can’t be ignored. Donald Trump has nudged the EU toward buying Russian gas. Trump doesn’t always get what he pushes for, but whatever he enters becomes immediately more complicated. France and Germany have accepted to buy some Russian gas, but the EU mandate implies that this is a very short-term arrangement. If Trump can get a ceasefire, and it extends to a resolution of the conflict, we need to know what Russia’s capabilities are, and they are very large. Here is a map of gas pipelines from Russia to Europe. |

|

|

|

|

Figure 2: The major gas lines from Russia to Europe Even with the Ukrainian invasion settled, there is little likelihood that all of Europe would agree to buy Russian gas, even though it would be cheap and abundant. The 2022 mandate assures that. Some gas could come through Turkey, for example, and some countries might be willing to buy it under those conditions. Russian LNG supply through the TurkStream pipeline, which accounts for all of Gazprom’s pipeline exports to the EU, has actually risen 16% year-on-year in the first quarter of 2025, attributed to higher demand in Hungary and Slovakia and additionally fueled by steep discounts on Gazprom LNG. How, then, should natural gas be traded? Those who want to treat the scenarios as equally likely should simply stay out; cash is a legitimate position. But please realize that an EU mandate says that the natural gas storage units must be at least 90% full by November 1. So, Europe will have to buy a very large amount of natural gas over the summer. Taking a long position somewhat above the long-term average curve could easily be a winning trade through October.

|