|

Energy prices struggle to provide a reliable short-term outlook as supply and demand dynamics, shaped by geopolitical shifts, continually reshape the energy landscape. |

|

|

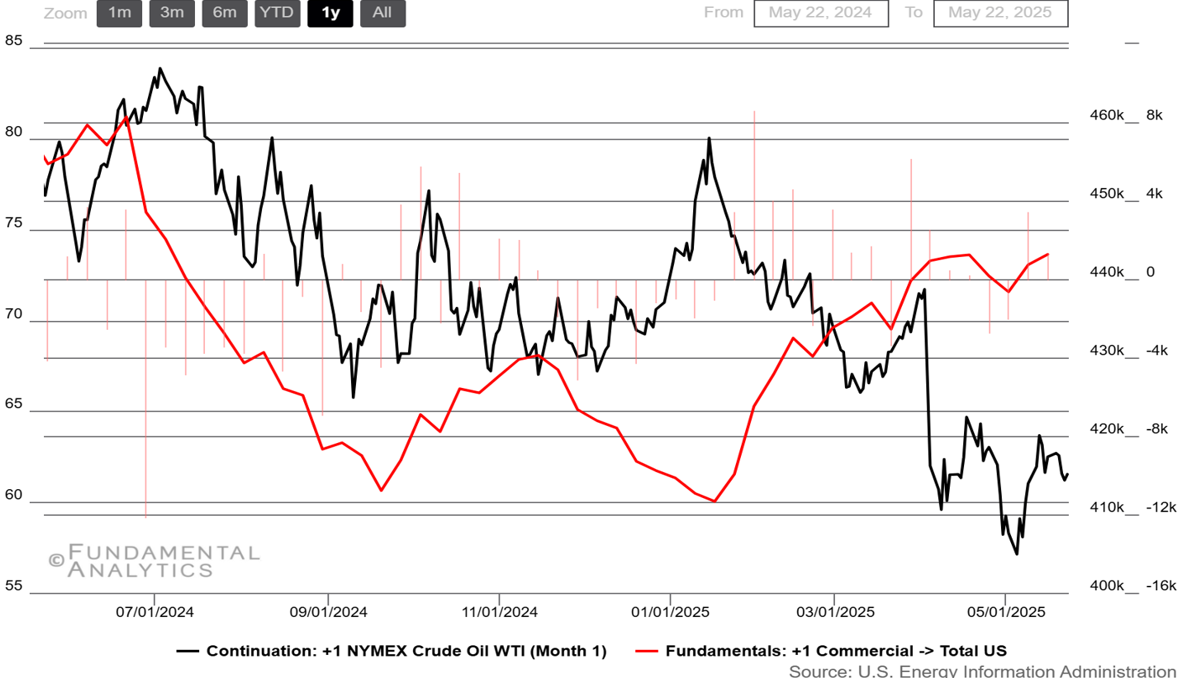

Crude Oil

WTI Prices Struggle on Unexpected Build-Up |

|

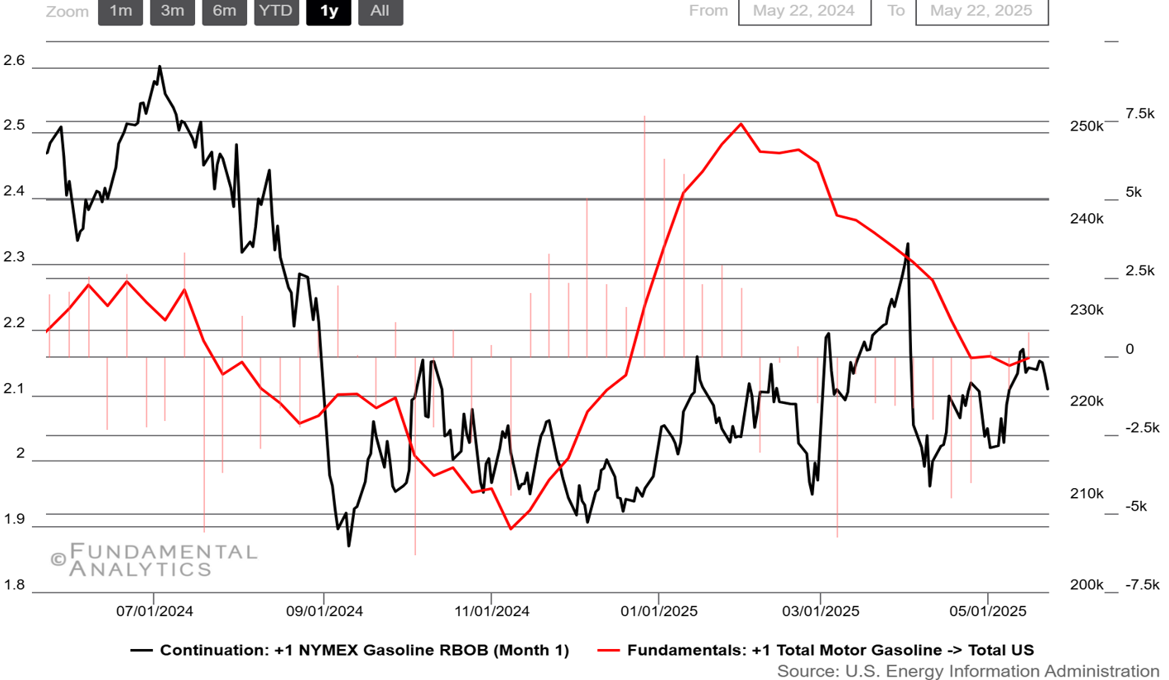

GasolineGasoline Futures Fall from Oversupply from Iran |

|

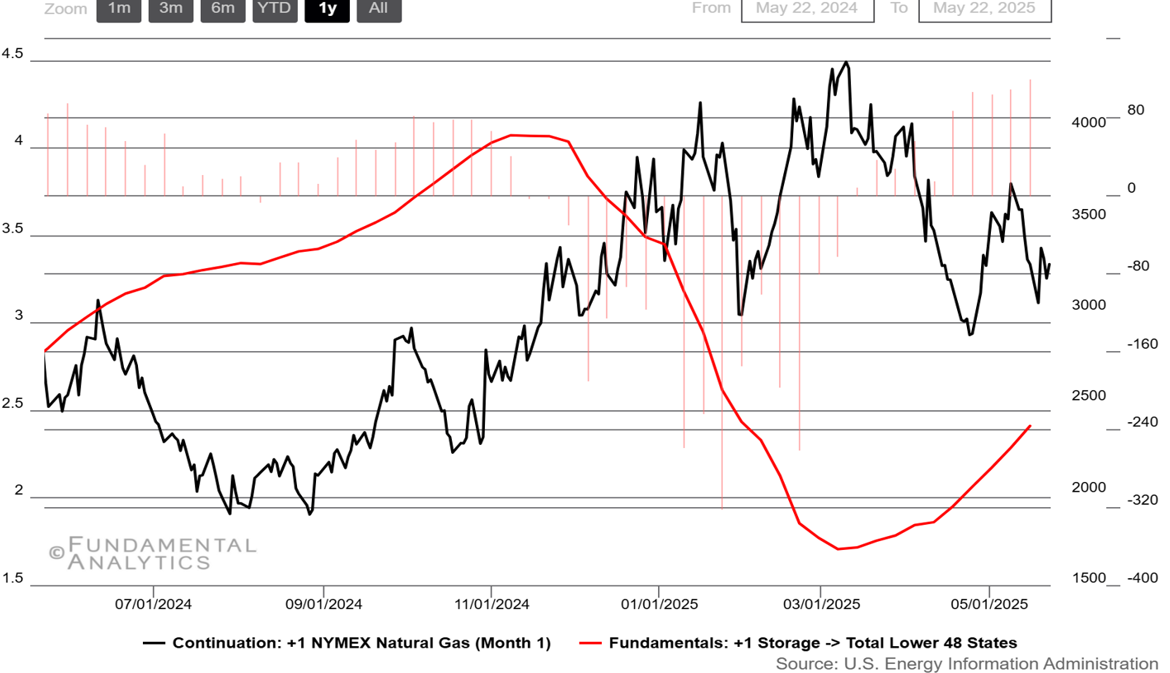

Natural GasNatural Gas Futures Remain Below $3.5 Mark |

|

|