|

Dr. Ken Rietz |

|

|

|

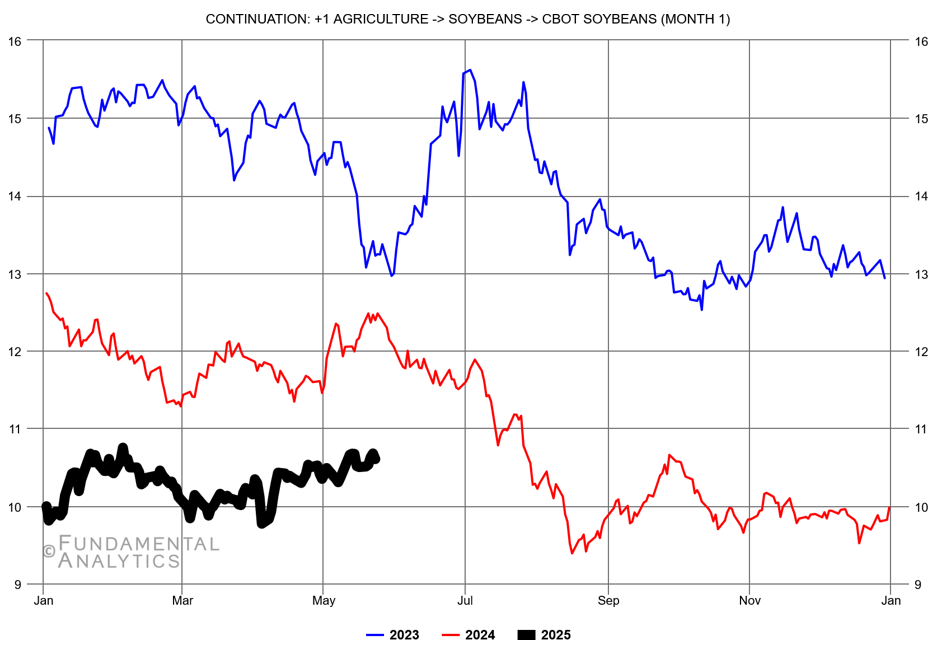

On May 15, soybean contracts dropped limit down ($1.00 per bushel) and soybean futures came close to their limit down as well. The reason is technical, but important, and we cover it in this week’s commentary. We will have to travel into the realm of government regulations to find the actual causes, and to determine what is likely to happen with them to make some estimate of what will happen next. But first, we need to look at the values of soybean futures for the past two and a half years. |

|

|

Figure 1: CBOT soybean front-month futures prices

The prices of soybean contracts or futures do occasionally go limit up or down. It should not be a matter of any concern. The CME resets the limit values every six months to maintain a reasonable range of trading each day but narrow enough to protect those who are trading. Note that the CME reset the limit down for soybeans on May 1. However, a much closer look at the prices can show the drop much more clearly. Below is the hourly price data for the June 2025 soybean futures (ZSN25). The crosshairs are at the time when the prices fell. |

|

|

Figure 2: CBOT soybean front-month futures prices Note that earlier that week, the prices fell roughly the same amount, but not for the same reason. Now let’s get into the legislative weeds. The US Energy Information Administration (EIA) sets up the basic regulations: “The Renewable Fuel Standard (RFS) is a federal program that mandates the incorporation of renewable fuels into the nation’s transportation fuel supply. Each year, the U.S. Environmental Protection Agency (EPA) issues RFS rulemakings with volume requirements for certain renewable fuel categories and sets those volumes through annual renewable volume obligations (RVO). RVOs are the volumetric biofuel targets for obligated parties such as refiners and importers of petroleum-based gasoline or diesel fuel.” Since soybean oil is one of the major sources of biodiesel, the amount of biodiesel directly affects the amount of soybeans used for soyoil. The evening of May 14 (the overnight market time for May 15), reports were circulated that the EPA proposed a value for RVO that was well below expectations. The resulting significant drop in demand for soyoil caused the futures price for soybeans to drop substantially, bumping up against the limit down price. How does this affect trading soybeans? The markets will have completely absorbed the price effects of that report almost immediately. But the implications of the change in direction of the EPA’s recommendations are harder to gauge. It is clear that the EPA is inclined to take a more hands-off approach, and that could again reduce the amount of biofuel that is recommended or mandated. This would lead to more decreases in the price of soybeans. Playing soybean futures shorter than average could be a useful strategy.

|