|

Conventional energy commodities saw an upward trend as shifts in fundamentals and geopolitical dynamics reshaped market perspectives. |

|

|

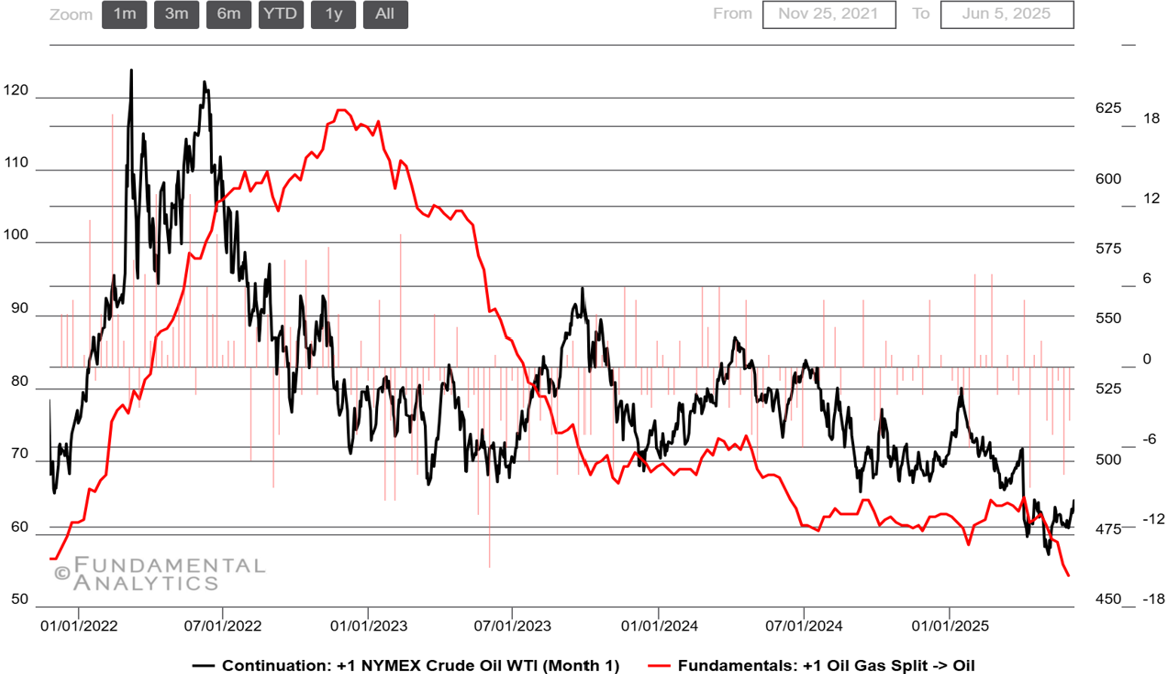

Crude OilShale drilling momentum slows, WTI reaches 2-month high |

|

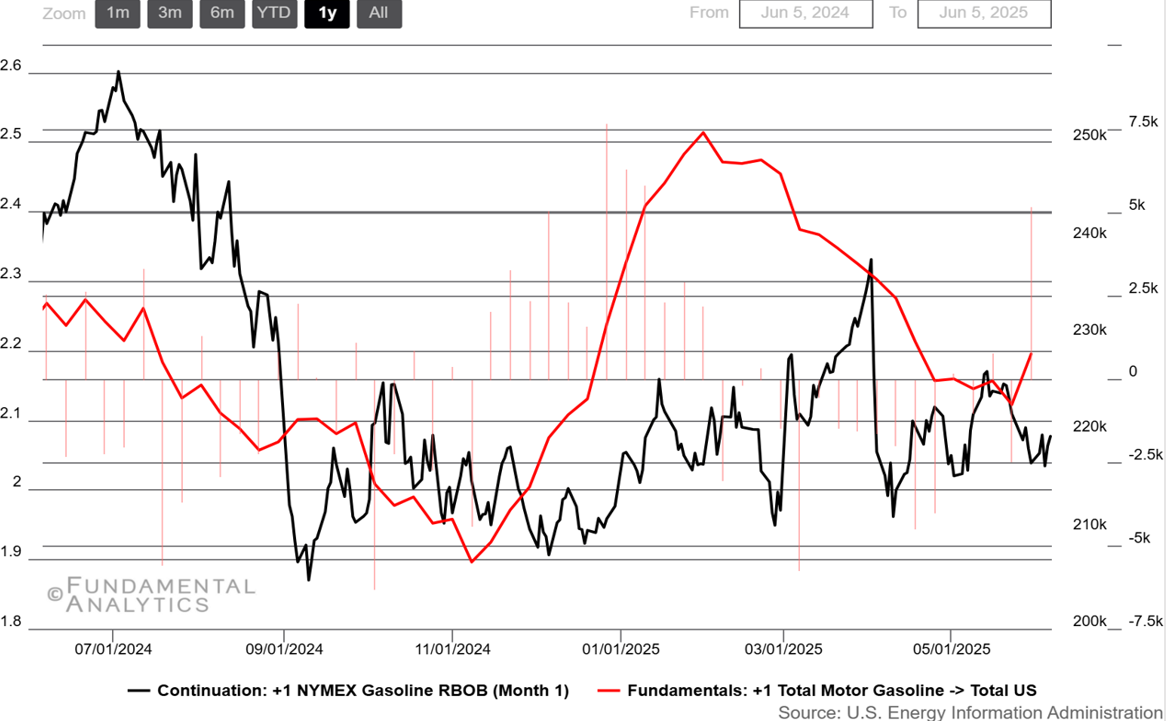

GasolineStorage saw strong buildup, futures fluctuate |

|

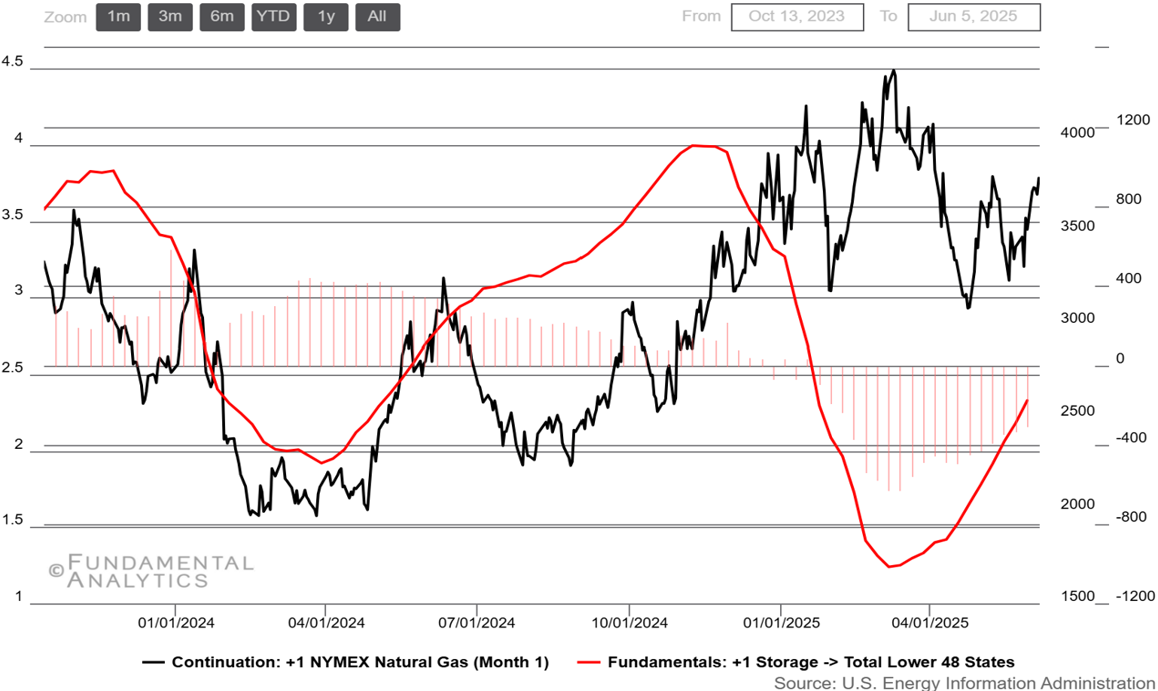

Natural GasInventory increases surpass seasonal averages |

|

|