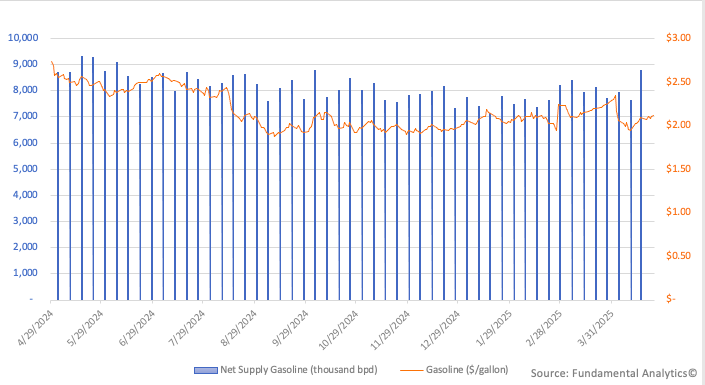

- Gasoline futures in the U.S. fell below $2.10 per ton, halting the rebound that peaked at $2.35 in early April, amid expectations of increased feedstock supply for major refiners and growing downside risks to demand from the top energy consumer.

- In addition to boosting supply to a key consumer market, the move risks further tensions among OPEC members, as producers struggle to keep output below their production quotas despite the group’s unexpected plans to increase output at three times the previously expected pace in May.

- Meanwhile, concerns over the escalating trade war with the United States led Chinese fuel imports to slump by 29% month-over-month, pushing domestic gasoline supply to a 10-month high.

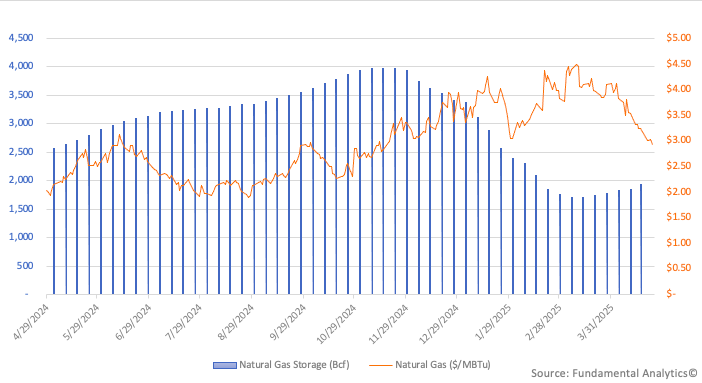

Natural Gas

Natural Gas Prices Plummeted to Multi-Month Low

|