Dr. Ken Rietz

August 30, 2023

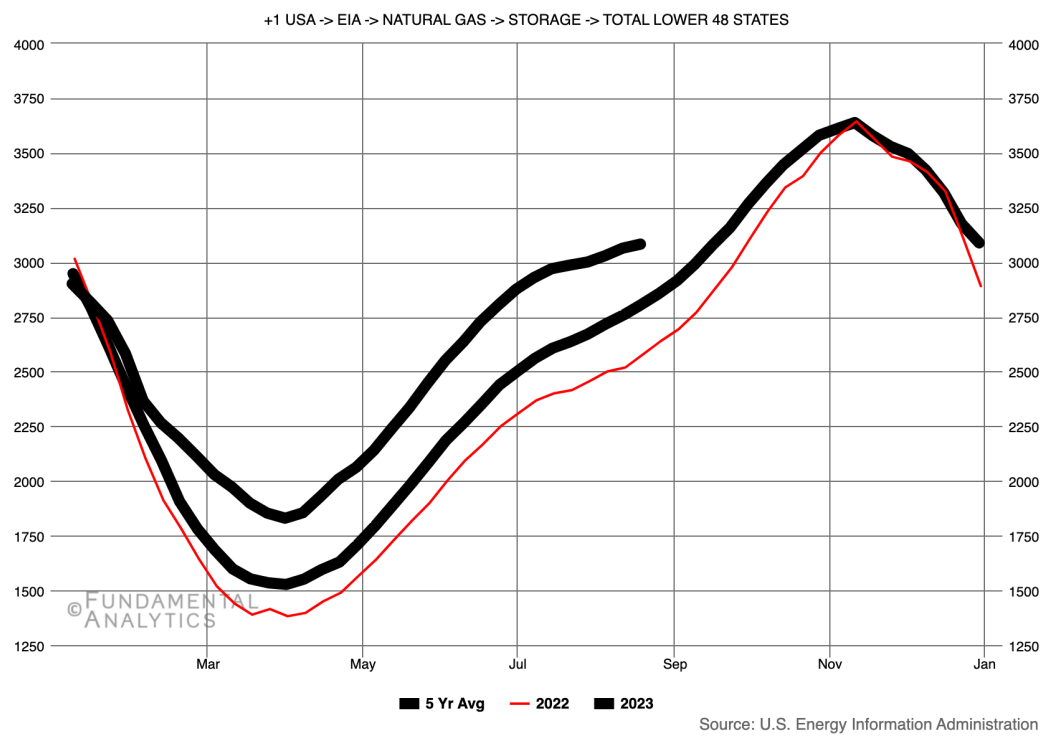

The September NYMEX Natural Gas Futures contract closed at 1% higher on Thursday, October 24. That is completely unremarkable, within a typical day’s range. But natural gas storage numbers had been released the day before, and were higher than the previous numbers, so you would expect that the contract price would go lower. There is a lot more happening beneath the surface; let’s look more closely. Here is a graph of the natural gas storage figures:

Figure 1: Natural gas in storage, in Bcf, continental US

One basic rule of market operations is that the market is always looking ahead, reacting to all new information as it becomes available. The weather forecast, for example, is a potent driver of natural gas prices. Natural gas is used for generating electricity for air conditioners in the summer, but even more for generating heat in homes during the winter. But in this case, the weather forecast had only minimal changes, far less than what would affect natural gas prices. The other major driver for natural gas prices is the weekly report on natural gas storage by the US Energy Information Agency (EIA). They reported a net increase of 18 billion cubic feet (Bcf). As I said earlier, this would normally be expected to lower the price of natural gas, mildly. The reason the price went up is that the market not only reacts to information as it comes out, but it also predicts what that information will be, and sets prices accordingly. In this case, the market was predicting an increase of somewhere between 27 Bcf and 50 Bcf. The price therefore had to go up as a result of the smaller-than-expected increase in storage.

The markets rarely are off by that much, though. What happened? The increase this same week during last year was 54 Bcf, so this year’s estimate doesn’t seem too far off. If you look at the region-by-region changes, the increases all would easily have been what is needed to fall into the 27 to 50 Bcf range, except for one, South Central Region, or effectively, Texas. That region dragged the storage numbers down a lot.

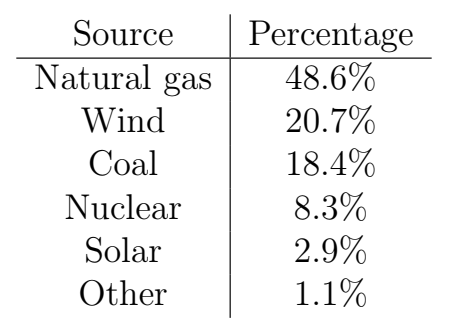

Texas has been sizzling hot since June, so an increase in natural gas usage is reasonable to expect, but not as much as happened. The sources for generating electricity in Texas are varied.

The weather in Texas was not only roasting hot, but the wind was substantially weakened, so wind power was generating less than usual. Coal could not make up the difference, so natural gas had to. (This is another part of the reason that weather affects natural gas prices.) And all this is what caused the major increase in natural gas usage in Texas, that led to the lowered amount of natural gas going into storage, and the slight increase in natural gas contract prices.