Welcome to the fourth issue of our monthly newsletter, Carbon Market News Roundup, the goal of which is to introduce our audience to a new asset class market in the making: the carbon market. Our previous issues, along with the rest of our commentaries, may be read here.

In order to meet their net-zero emissions pledges, global firms turn to carbon credits to offset their unavoidable emissions. Carbon credits represent CO2 that has been reduced, avoided, or removed from the atmosphere. Projects that reduce, avoid, or remove carbon from the atmosphere can generate credits and sell them to polluting companies, who then ‘retire’ the credits to offset their emissions. Already, the carbon market is worth over $900 billion and is expected to reach $2.68 trillion by 2028.

Last issue, we focused on the dynamics that drive capital investment in decarbonization efforts, as well as the rising number of regulated carbon markets emerging around the world. In this issue, we will examine the very real danger that climate change poses, and how carbon markets, specifically voluntary carbon markets, are essential in the fight against climate change.

Climate Change is a Threat

2024 Begins With More Record Heat Worldwide

Raymond Zhong & Elena Shao, The New York Times

Have We Crossed a Dangerous Warming Threshold? Here’s What to Know.

Raymond Zhong, The New York Times

Global warming fuels extreme wildfires in a feedback loop

Akira Oikawa & Takashi Tsuji, Nikkei Asia

January 2024 became the hottest January on record, marking eight consecutive months of record-breaking heat. 2023 was the hottest year in over a century. These aren’t mere statistics; they’re stark warnings. The culprit? The relentless burning of fossil fuels, pushing Earth closer to a 1.5-degree Celsius temperature rise compared to pre-industrial times, a threshold to be avoided under the 2015 Paris Climate Accords. This seemingly small number translates to catastrophic consequences: deadlier heatwaves, rising sea levels, biodiversity loss, prolonged droughts, and devastating storms.

The problem is intertwined. Climate change intensifies weather patterns like El Niño, making them more unpredictable. This, in turn, fuels wildfires, which release huge amounts of CO2 back into the atmosphere, perpetuating the cycle. Last year’s Canadian wildfires, for example, emitted three times Canada’s usual emissions, darkening the skies of major US cities.

Worse, forecasts predict a worrying increase in large wildfires in the coming decades. The consequences of a warming globe even bring to mind biblical punishments, with a recent study suggesting climate change could expand the area vulnerable to crop-devouring locusts by 25%.

The message is clear: rapid reductions in greenhouse gas emissions are our only hope of stopping the climb. The alternative is a future defined by climate chaos, impacting every aspect of our lives. But, if reports that it will cost the global economy an average $9.2 trillion in average annual spending to reach net-zero emissions are true, how can we begin to take on this challenge?

Voluntary Carbon Markets Can Help

A blueprint for scaling voluntary carbon markets to meet the climate challenge

Christopher Blaufelder, Cindy Levy, Peter Mannion, & Dickon Pinner, McKinsey Sustainability

Carbon Offset Demand Hits Record in 2023 Off Huge December

Kyle Harrison, BloombergNEF

Carbon Credits Face Biggest Test Yet

BloombergNEF

While mandatory regulations will play a crucial role in combatting climate change, the voluntary carbon market (VCM) offers an additional avenue for individuals and businesses to contribute, even outside of different regulatory frameworks. Unlike mandated markets, VCMs operate on an incentive-based system where participants can purchase carbon credits to offset their emissions on a voluntary basis. Each credit represents a ton of CO2 that is avoided, reduced, or removed from the atmosphere, and the credits are verified by independent certification entities.

In the short term, VCMs drive investment towards renewables, energy efficiency, and natural capital, accelerating the shift away from fossil fuels. This avoidance of emissions is considered the most cost-effective way to address greenhouse gas concentrations in the atmosphere.

Looking further ahead, VCMs can play a critical role in scaling up CO2 removal capacity, crucial for neutralizing emissions that cannot be further reduced. Experts estimate that at least 5 gigatons of negative emissions will be required annually to achieve net-zero emissions by 2050.

Beyond emissions reduction, VCMs offer additional positive impacts. They direct private financing to projects with social and environmental benefits such as biodiversity protection, pollution prevention, public health improvements, and job creation. Moreover, VCMs mobilize capital towards the Global South, where there is significant potential for cost-effective nature-based emissions reduction projects, aiding regions often disproportionately affected by climate change.

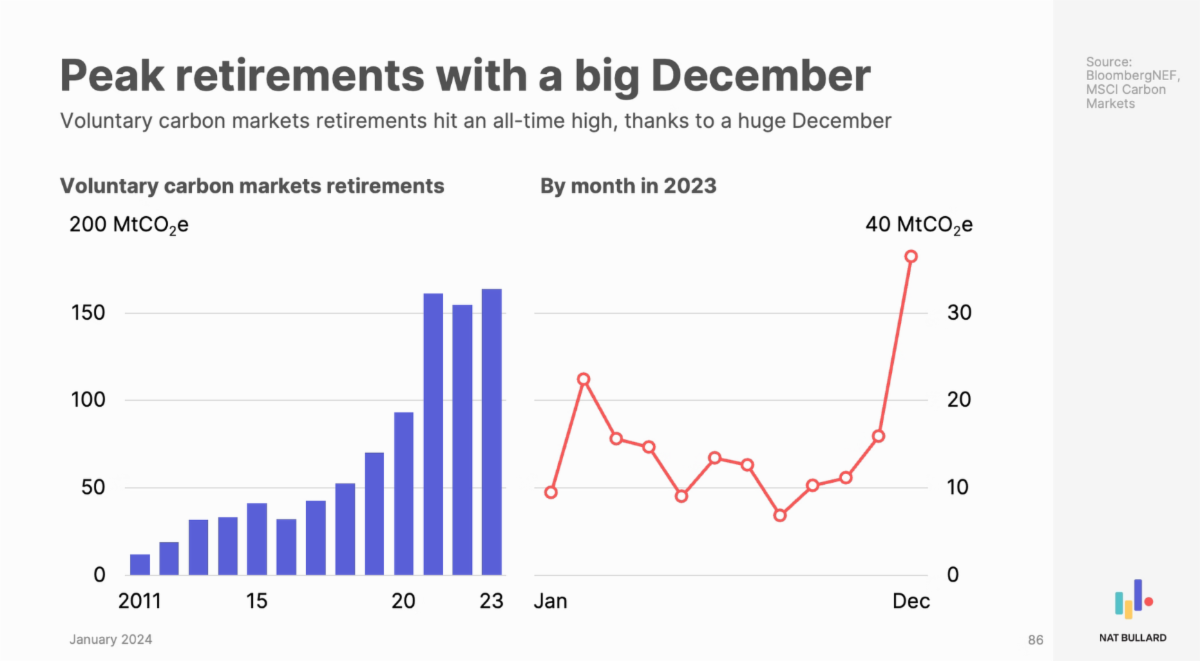

The VCM is also undergoing a period of change. Last year, retirements of voluntary credits (where a business or individual ‘uses’ the credit to count against emissions) reached a record high in December:

The companies involved in December’s jump in retirements included giants such as Shell, HP, Microsoft, and Nestle. While annual retirements are a key indicator of demand for voluntary offsets, trust in the quality of offsets is a crucial component of demand. Luckily for the VCM, initiatives like the Integrity Council on Voluntary Carbon Markets, as well as regulators like the US Commodities Futures Trading Commission, are laying the groundwork for higher standards in the VCM. With the market benefiting from a strong foundation, prices of offsets could rise from the single-digit dollar amounts today to up over $238 per offset by 2050. In this scenario, the market could peak at $1.1 trillion from its worth of $2 billion today.

The voluntary carbon market serves as a vital tool for decarbonization, offering individuals and businesses an avenue to contribute beyond regulations while driving investment towards a more sustainable future. Its potential for financing negative emissions and supporting vulnerable regions further makes it an even more critical tool in the fight against climate change.