Energy futures continue to display increased volatility amid supply and demand concerns, while uncertainty prevails in every outlook.

|

Crude Oil

Crude oil inventory rises, pushing prices down |

- WTI crude futures declined by around 2% to below $75.5 per barrel from the previous week – the third consecutive week of losses – driven by increasing expectations that borrowing costs could remain elevated for an extended period, which negatively impacts demand.

- Meanwhile, EIA data revealed that US crude inventories increased by 1.23 million barrels last week, a reversal from the previous week’s 4.16 million barrel decline and contrary to market expectations of a 2.3 million barrel draw.

- Concerns over a potential supply surplus were also heightened earlier in the week following the latest OPEC+ decision. While OPEC+ agreed to extend most supply cuts (3.6m bpd) into 2025, they also announced plans to gradually phase out some voluntary output cuts from eight member countries starting in October.

Gasoline

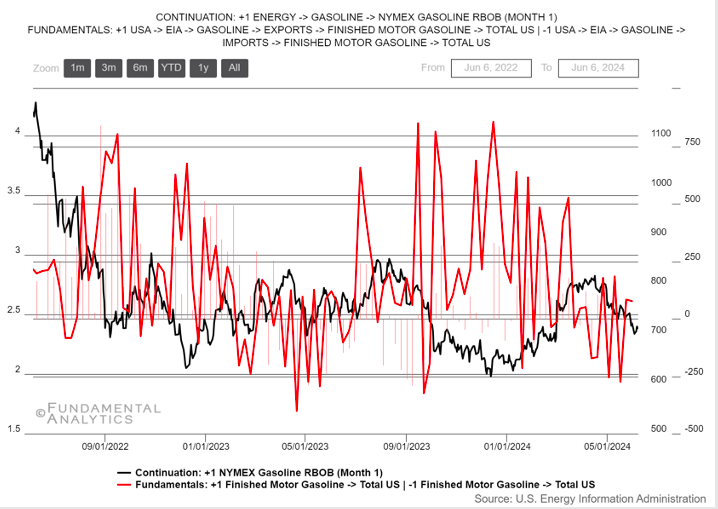

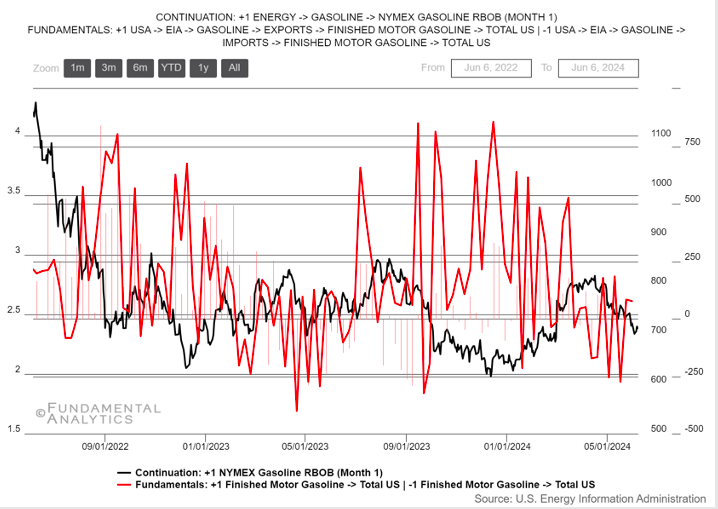

Gasoline prices struggle to find pattern

|

|

- Gasoline futures in the US were below $2.40 per gallon last week, holding near the lowest level since February, tracking the sharp pullback for crude oil amid an outlook of ample supply.

- Oil-derived fuels extended their bearish movement after the OPEC+ nations agreed to relax their oil output cuts this year.

- These developments added to the pessimistic outlook for fuel demand as manufacturing activity in the US and China struggle to gain traction

- In the meantime, data from the EIA showed that gasoline stocks surged by 2.1 million barrels from the prior week in the period ending May 31st, while commercial net exports remained at a one-year low.

Natural Gas

LNG prices surge, despite excessive buildup

|

|

- US natural gas futures surged to $2.9/MMBtu last Friday, marking a more than 12% increase for the week, driven by expectations of increased cooling demand due to warm weather forecasts for June. Forecasts indicating above-normal temperatures in various regions.

- Also, US gas production is still down around 9% in 2024, as energy firms delayed well completions and reduced drilling activities earlier this year.

- On the other hand, the latest EIA report showed a larger-than-expected storage buildup (+98 bcf actual vs +89 bcf consensus) last week, bringing gas stockpiles 26.5% higher than the seasonal average.

|