|

Dr. Ken Rietz |

|

|

|

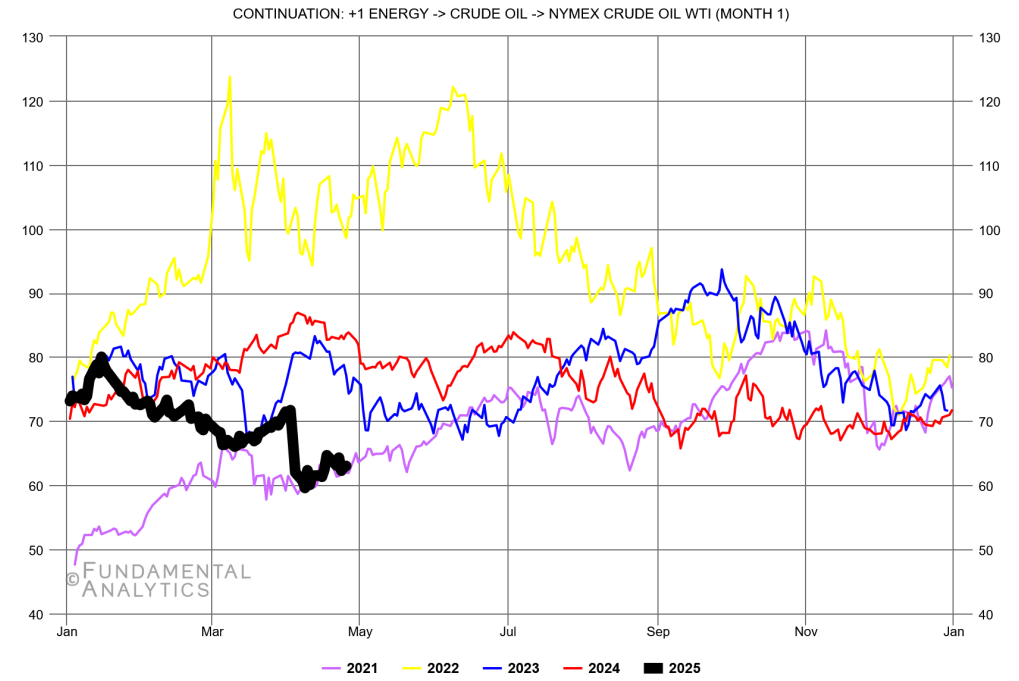

It is in times such as these that you begin to realize how interconnected the world is. The number of potential causes of the drop in the price of crude oil is enormous. We will focus on the three main ones here: macroeconomic (tariffs), supply and demand (OPEC+), and geopolitical (China, Iran, Ukraine). Of course, there is some overlap, but most causes fall generally into one of these. We begin with the graph of WTI crude front-month future prices. Brent crude oil is very similar. |

|

|

Figure 1: WTI crude oil front-month prices You can see very clearly the rapid drop in the price of WTI crude oil on April 3, 2025, the day after Trump’s self-declared “Liberation Day” when he announced his staggeringly wide range of tariffs. You can also see that the price of WTI has struggled unsuccessfully to recover from that fall. There are factors in play so that the prices couldn’t rebound, quite unrelated to tariffs, so I categorize those reasons also as causes of the drop. Clearly, tariffs are the macroeconomic event that triggered the price drop. The increase in price caused a drop in demand and so did an increase in supply, which limited any potential gains in crude oil futures prices. In fact, US crude oil prices have tumbled to multi-year lows. The general uncertainty about which tariffs will actually be imposed, reduced, suspended, or cancelled drives chaos in the markets, and pressed (without much success) for higher futures prices. But tariffs aren’t the only factor pressing down on oil prices. Supply and demand compound the problem. Specifically, Saudi Arabia is pushing for faster production hikes at OPEC+, partly due to cracks appearing in the unity of the organization. Kazakhstan has declared that it will operate according to its own needs, rather than follow OPEC+ guidelines. Markets are taking this to mean that OPEC+ will keep producing more crude oil, whatever production limits they agree upon, and oil prices are depressed as a result. Finally, there are geopolitical events. China is suffering under heavy punishment from the US. The US administration claims to be negotiating with China, but China will not acknowledge it, since they do not want to be seen as bowing to US force. But cracks are forming on both sides, with reductions in tariffs on specific critical items. But Iran is more central to oil, since they are a major producer. Progress in the US-Iran nuclear talks has sparked fears at the prospect of Iranian oil re-entering the global market and further aggravating a bearish trend in oil. A similar scenario applies to the Russian-Ukrainian war, since both Russia and Iran are getting desperate for money, and restricted from selling their vast reserves of crude oil. The effects of the oil stock expansion hit private producers hard. Costs of steel (again due to US tariffs) only make the situation worse. Fracking drops as demand drops. Another casualty of the chaos is the upstream oil and gas producers. Lower E&P spending, on top of oversupply, makes for much tighter operating budgets. As the economy slows, demand for oil slows as well. The International Energy Agency (IEA) now predicts that oil demand will drop to its lowest level in five years. How do you trade this situation? Markets are in such chaos that attempting to make money through investing is probably a bad idea. Any edge you might have is effectively gone, making it more of a gamble than an investment. The only serious reason for buying futures or options is for hedging, and even that is risky right now. If you must, I would recommend using credit spreads (with a credit of at least 40% of the spread), since the volatility is high. |