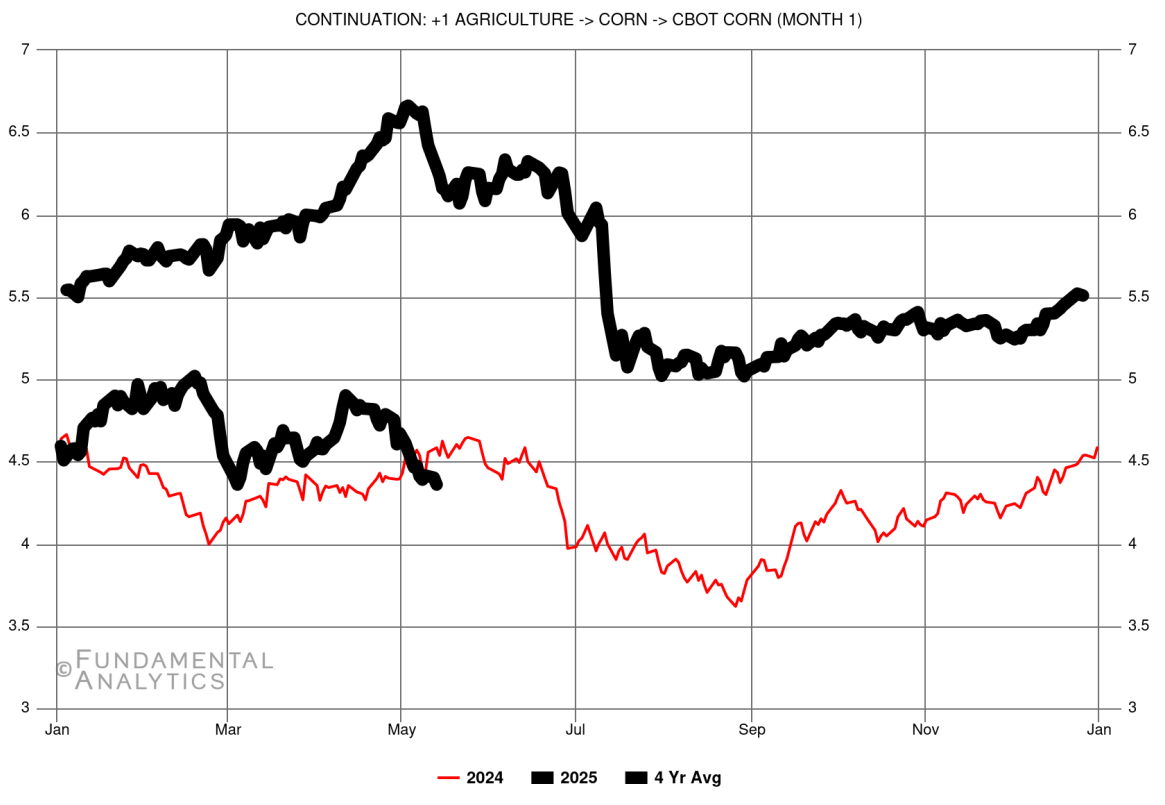

The corn market has shown a variety of unusual behaviors in the past few months. Twice this year, corn prices have moved contrary to the long-term average, for extended times. We will look at the causes of both and then we will look at ways to use this information to trade corn. But first, we need the big picture, how corn has been moving since the beginning of 2024, with the 4-year average (I picked the 4-year average rather than 5-year, in order to avoid the early market oddities from the pandemic).

Figure 1: CBOT Corn front-month futures prices

As you can see, the price of corn futures started to drop on 2/18/2025, while the moving average was still going up. This is not unusual, except that this drop lasted for several weeks, until 3/3/2925. The futures price then migrated upward again (now following the moving average) until 4/4/2025, when it started dropping again, continuing to do so until now. Interestingly, the reasons for the two drops are quite different, as we shall soon see. It is useful to enlarge the action of the corn futures year to date, which is given in the graph below, source Yahoo Finance.

Figure 2: CBOT Corn front-month futures prices

It is helpful to note that the vertical scale is much smaller in this graph than in the first one. This magnifies to the size of the drops, which is perhaps unfair. Now, let’s begin to analyze the causes of the first drop. The two arguably biggest reasons were an expected high crop yield from Brazil and increased projection of the size of the US crop. Brazil has two main corn crop cycles each year, and at this time, they were expecting a high yield from the second crop. This crop, highly exported, decreases the exports of US corn, thereby increasing the US supply. Also, there were projected higher US yields, also increasing the supply of US corn. These are classic major causes for the corn futures price to drop, but they are not the only ones in this case. We also had a high carryout (amount of corn left over from sales and exports, stored for sale later) from the previous year. The net effect of these events was a drop in corn futures prices, until the market decided that the price fairly accounted for them, which occurred at roughly 3/3/2025. The price followed (albeit from a lower level) the 4-year average until roughly 4/4/2025.

On that date, the futures prices started dropping again, and contrary to the average price, continuing until at least 5/14/2025 (the date this was revised). Why this drop? Again, the news presented a large number of reasons. The biggest reason is probably a faster-than-normal rate of planting in the US, which usually indicates a higher-than-normal crop size. Combine that with a larger Brazilian crop than usual and you have again classic reasons for a dropping corn futures price. But, as before, there are additional reasons. There was also pullback from perceived overbought conditions and a general weakness in the corn markets. And, of course, you can’t ignore the effects of tariffs.

What does this imply for trading corn futures? Overall, the market ahead looks to stay somewhat level, with little opportunity for arbitrage. Absent significant movers, the field looks ripe for iron condor trades or possibly calendar spreads. Notice that should tariffs again become active, this would immediately add chaos to the market, and the recommended strategies would become much less likely to work well. During tariff negotiations, no trading strategy can be expected to work.