|

Agricultural futures tumbled on fundamental factors, as oversupply concerns weighed on markets and demand for U.S. agricultural exports continued to fade. |

|

|

|

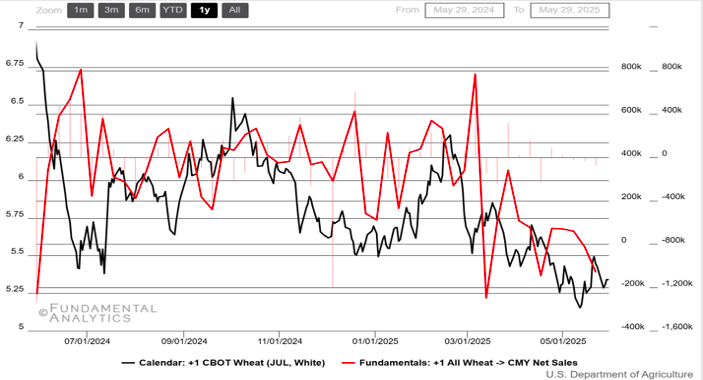

Wheat |

|

CBOT Wheat Pressured by Weak U.S. Exports and Expanding Black-Sea/Australian Supplies |

|

|

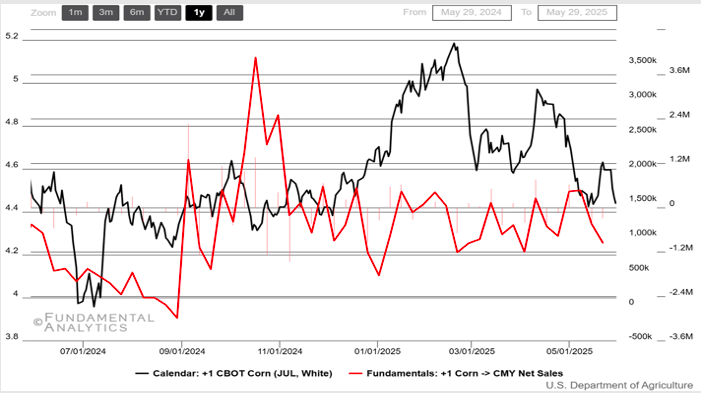

| Corn |

|

CBOT Corn Stalled by Fast U.S. Planting, Sluggish Exports, and Record Brazilian Supply |

|

|

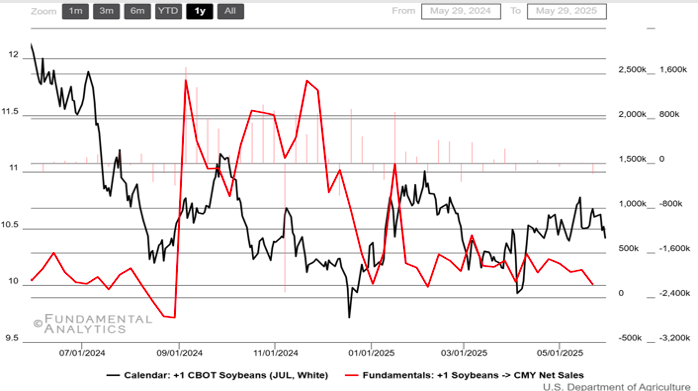

| Soybeans |

|

CBOT Soybeans Slide on Rapid U.S. Planting, Weak Exports, and Record Brazilian Crop |

|

|