|

Dr. Ken Rietz Last week’s Israeli extensive bombing of some of Iran’s nuclear, military and energy targets has thrown the crude oil market into major confusion. The price of crude oil, of course, spiked on the news, and uncertainty ruled just about everyone’s attitude. A few days have passed since the event, and cooler heads have had a chance to analyze the whole scene. This week, we want to look at what is reasonable to expect from the near and long term effects on the crude oil market. But first, here is the graph of the ICE Brent Crude front-month futures. |

|

|

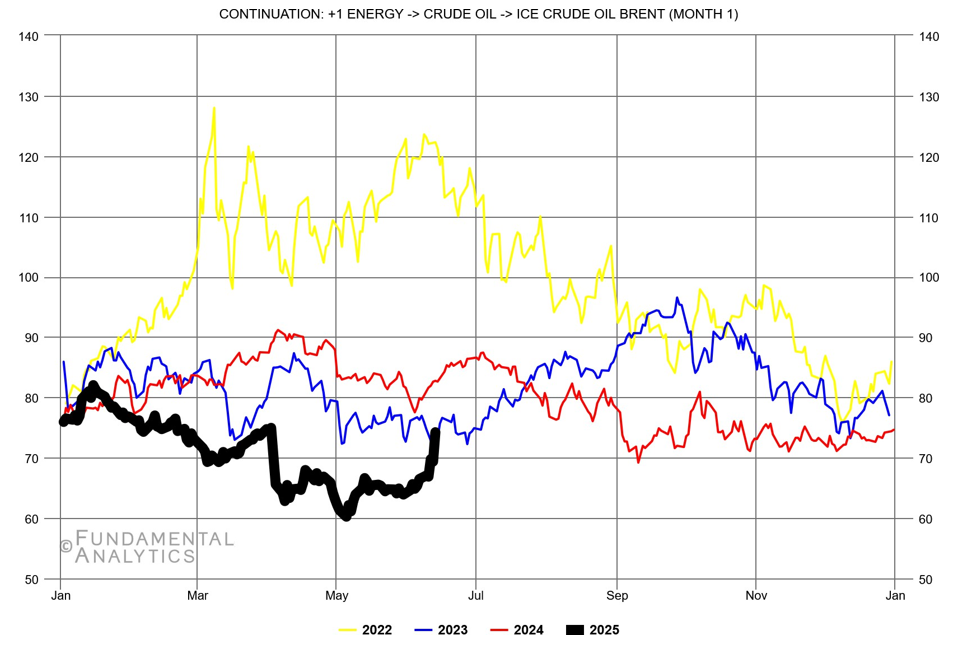

Figure 1: ICE Brent crude oil front-month futures prices

The jumps in Brent Crude were the highest since Russia invaded Ukraine, but it settled down at the close of Friday’s trading. The result is that the drops over the past several weeks were completely wiped out, but further drops might still happen, eventually. The initial Israeli strikes did not affect Iran’s petroleum industry, according to Iranian sources. But later bombing did target gas and oil facilities. The previous time that Israel bombed Iran, Iran somewhat softly replied and nothing else happened. This time, the bombings from both sides have continued and even escalated. As a result, the global crude oil trade is holding its breath. There is no clear finish here; now Israel expects to continue bombing until Iranian nuclear capabilities have been eliminated, and that is estimated to take several weeks. Even WTI crude prices have spiked, not because there is any threat to it, but rather because demand spiked for the cheaper US oil. The future is not clear. Iran has been refusing to accept any plan that eliminates their ability to refine uranium, insisting that they have no intention of building nuclear weapons. This is an odd assertion. Iran has so much petroleum that they don’t need nuclear energy. Plus, they are enriching uranium far beyond the concentration needed for civilian nuclear power. Iran’s refusal makes the scenario of no more Israeli strikes harder to imagine. Israel’s fears have some foundation. Reuters reports that crude oil prices are stabilizing, since the flow of crude oil does not seem to be very adversely affected. That, however, could change easily. One point of serious concern is the Strait of Hormuz. Iran borders that strait, so that it could, if it wanted, shut it down. While that is not the most likely scenario, the threat of this happening is enough to cause the price of oil to go up some, since about 20% of global oil passes through there. It is a place to keep in mind during this war. The direction for trading crude oil is hazardous. Crude oil prices had been historically low, until the Israeli strikes. Now, they are going higher, and chances are that they could stay high as long as the mutual bombing continues. |