Mid-Week, Weekly Review of Gold, Silver, and Palladium

December 2, 2020

Gold remains slightly below and silver above the support lines identified in last week’s report, which are $1850 and $23, respectively. As is often the case, the gold support line may now act as resistance holding gold below $1850 for the near term unless there is a significant weakening of the dollar, a fall in the 10-year Treasure yields, or a jump in inflation expectations.

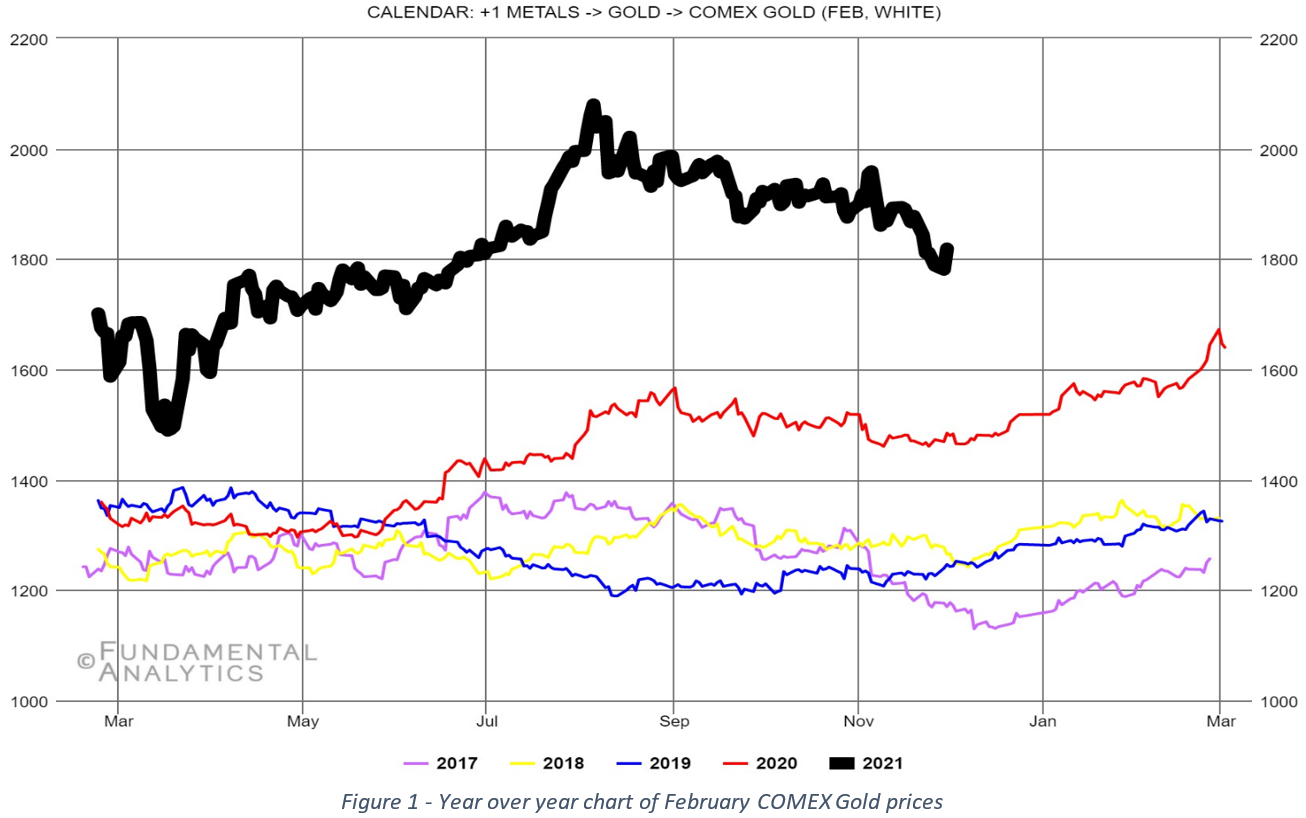

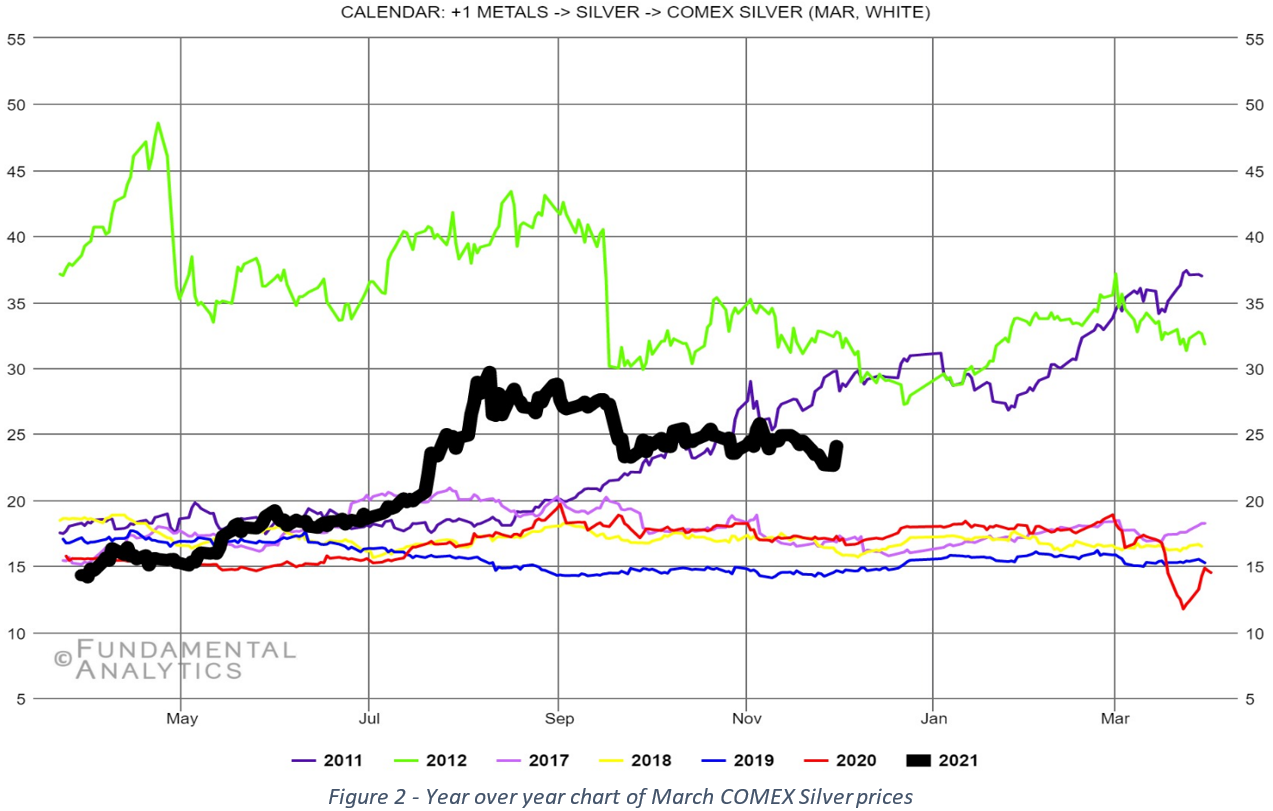

The front month contract for gold and silver were up 0.52% and 3.18% respectively at the close of trading yesterday, with respect to the close on November 24th, 2020. The ratio of the month 1 Gold contract to the month 1 Silver contract is down 2.58% compared to the close on the 24th, falling to the lowest level since the middle of September. With the front month gold and silver contracts closing yesterday at $1814.10 and $24.03, respectively, the gold/silver ratio is now 75.5, 14.3% higher than the corresponding 15-year average. February gold (Figure 1) closed yesterday at $1819.90, up 0.52% and March silver (Figure 2) closed at $24.09, up 3.18% from the close on November 24th.

From an open interest perspective, gold total open interest has fallen below the lowest level seen since early August 2020 but is still well above levels seen in March 2019, the beginning in the run up in gold price. The open interest reduction is consistent with closing of long positions as gold falls. It is also mirrored by similar moves in the latest CFTC report for gold (11/24) for non-commercial net position of funds. We have mentioned over the last several weeks that the CFTC data showed a continual reduction in net positions while open interest was remaining essentially constant. This is the first week where both open interest and CFTC data both show the trends moving down. Volume on Tuesday was below the 50-day SMA.

Now on to silver… Silver total open interest fell 6.7% since last week on November 24th. The most recent CFTC report for silver shows net position of funds seem to have reached a maximum and at least for the short term are beginning to trend down. An increase in non-commercial shorts is driving this trend. Where gold volume was down, silver volume yesterday was at the 50-day SMA. The Silver Institute released an interim report on November 17 and provided their outlook through the remainder of 2020. They see year-on-year supply and demand down 5.56% and 6.3% respectively, resulting in a year-on-year physical surplus increase of 21%. This year is the fifth uninterrupted annual surplus in the silver market, and they expect the strength in the global silver investment market will continue to absorb the surplus. Their report can be found here.

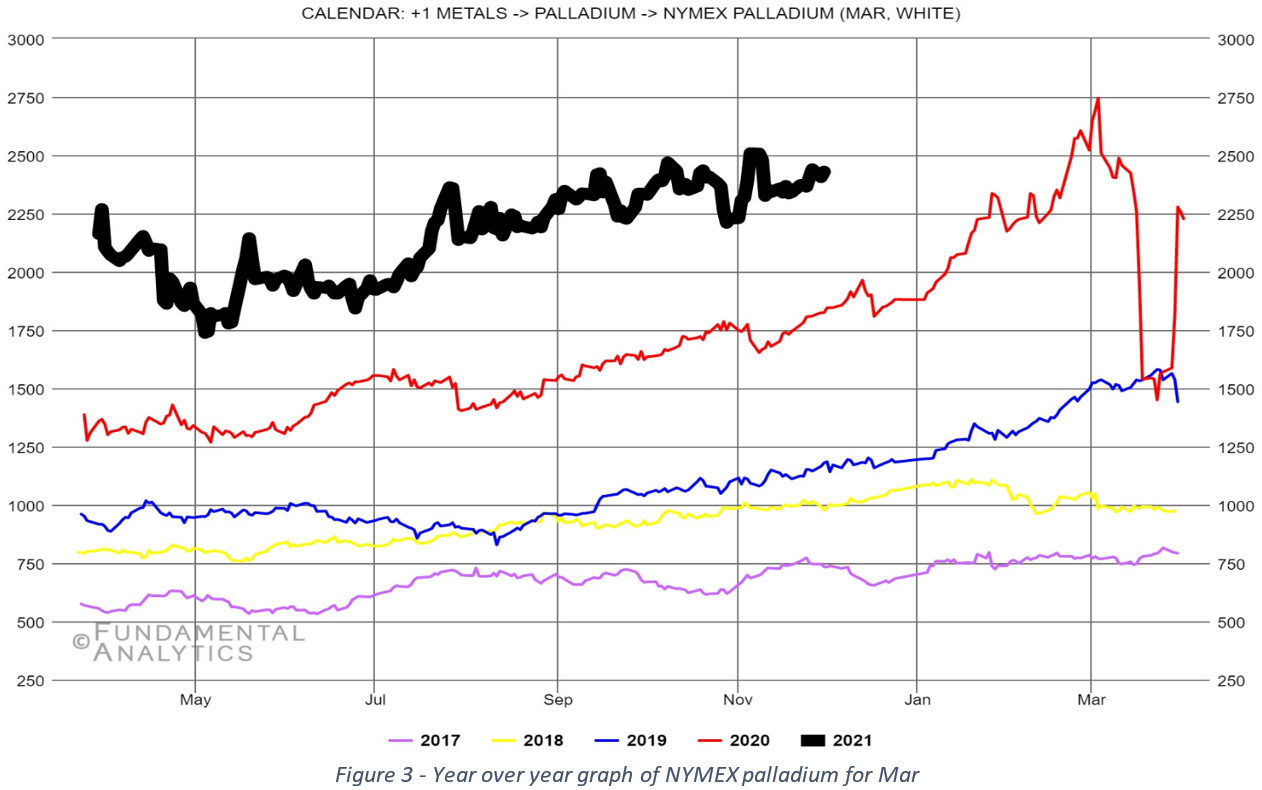

Now for Palladium. March palladium closed at $2429.7 yesterday, up 2.44% from the close last week Tuesday. Total open interest fell another 6.3% and is now down 10.3% from two weeks ago Tuesday. Overall, palladium volume is higher than the 50-day SMA, but the trend is going neutral. The November 24th CFTC report showed a 1.3% decrease in non-commercial net fund positions, with both long and short positions essentially moving sideways. With total opening interest continuing to fall while price moves up slowly, this makes one question if the funds were caught off guard by the continued strength in palladium while gold and silver weakened. For the last week the spot price of rhodium has remained constant as can be found here.

The final thoughts I leave with you today are around the price of gold, how the new administration will keep the economy moving and whether their path, combined with the path of the ending administration, will result in a deflationary or inflationary environment. The great people at Incrementum, inspired by the extraordinary events of 2020, have just released an In Gold We Trust Special found here. I would highly recommend everyone who invests read and take the time to really understand this report. Their report, combined with the one I mentioned last week by Lyn Alden, provide an excellent overview of how ‘this time’ might be different, with respect to inflation. On page 4, the authors state “Ever since stagflation in the US was defeated in the early 1980s, the global paradigm has been disinflationary. We suspect the Covid-19 crisis represents the beginning of a new inflationary paradigm.” Should inflation take off, it may surprise many people with how quickly it comes on. Their report provides some basic guidance on investments that tend to perform best in an inflationary environment.

If you would like access to the great insights and analysis provided by the Fundamental Analytics platform, sign up for a 15-day free trial and demonstration!

If you have any questions, please contact our Technology Manager, Mike Secen at [email protected]

We also invite you to read our other articles and follow us on social media!

Best Regards,

The Fundamental Analytics Team

The information provided here is for general informational purposes only and should not be considered individualized investment advice. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.